If you want to check the current price of a barrel of crude oil, you can find it in three seconds. If you want to know exactly how many mortgage applications were denied in Ohio last month, the Federal Reserve has a chart for that. We track every foreclosed home, every skipped credit card payment, and every dip in the stock market down to the decimal point.

But if you want to know how many American families were kicked out of their apartments yesterday? You cannot.

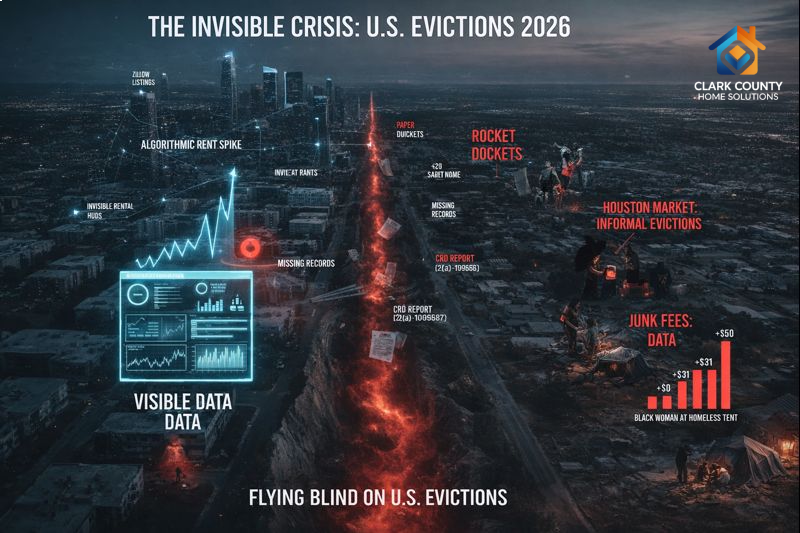

We are deep into 2026, and the U.S. housing market has a massive, dangerous blind spot. While economists obsess over Zillow listings and interest rates, the rental market is quietly breaking. A recent, scathing report from the Government Accountability Office (GAO) confirmed what housing lawyers have screamed for years: the federal government has almost no idea how many people are losing their homes.

We are flying blinds. And in cities like Houston, Las Vegas, and Phoenix, the crash is not coming; it has already happened.

Here is the reality of the 2026 eviction landscape, the “data void” that policy makers are ignoring, and why your zip code and your landlord’s algorithm might be the only things keeping a roof over your head.

The GAO Bombshell: A Black Hole of Data

Earlier this year, the GAO released a report (GAO-24-106637) that should have been front-page news. It was a formal admission that the U.S. lacks a comprehensive national database for evictions.

This sounds like a boring bureaucratic issue, but the consequences are violent. Because we treat eviction data as a “local issue” rather than a national economic indicator, we do not see the wave until it hits.

Eviction records are buried in thousands of separate county courthouse systems. Some counties have digitized their records; others still use paper files stacked in a basement. Some update daily; others, yearly. The GAO found that HUD and the Census Bureau have no unified way to “talk” to these local courts.

Without this data, Congress acts on guesswork. They allocate emergency funds based on population, not based on where the actual displacement is happening. It is like trying to put out a forest fire, but you are not allowed to use a map.

The "Return to Normal" Was a Lie

When the pandemic-era moratoriums and Emergency Rental Assistance (ERA) programs expired, the economic forecast was optimistic. Experts predicted a “return to pre-pandemic norms.”

They were wrong. In the Sun Belt and the Rust Belt, we did not just go back to normal. We blew past it.

The “Rocket Dockets” of 2026. In cities like Houston, eviction courts have turned into assembly lines. Housing advocates have dubbed them “rocket dockets.” In Harris County, it is not uncommon for a judge to decide a family’s fate in less than 90 seconds. In early 2025, filings in Houston were running 50% higher than historical averages, frequently surpassing New York City in total volume despite having a fraction of the population.

Las Vegas and Phoenix are telling a similar story. These cities were the darlings of the pandemic boom, everyone moved there for cheaper rent. But the hangover has arrived. Rents in these metros have surged 30-40% over four years, while service-industry wages have stagnated. The safety nets are gone, and the courts are packed.

The "Shadow Market" and Informal Evictions

The scariest part of the GAO report is not what they counted; it is what they could not count.

Official statistics only track court filings. They do not track “informal evictions.” This is the shadow market of displacement, and experts estimate it might be double the size of the legal market.

An informal eviction happens when a landlord does not want to pay court fees.

- They change the locks while you are at work.

- They take the front door off its hinges (illegal, but it happens).

- They offer “Cash for Keys” paying a tenant $500 to leave quietly by Friday.

None of these families show up in the data. They just disappear from the neighborhood and reappear in a shelter or a car. This “ghost data” means the crisis is significantly worse than even the record-breaking charts suggest.

The Demographics of Displacement

If we piece together the patchwork data from the Princeton Eviction Lab and local legal aid groups, a devastating picture emerges of who is losing their home.

The single group most at risk of eviction in America is not unemployed men. It is children.

Households with children are filed against at significantly higher rates than adult-only households. Kids are expensive. They require larger apartments (higher rent). They cause noise complaints. They get sick, forcing parents to miss work. In the ruthless math of the 2026 rental market, having a child is a liability.

The Racial Divide

It’s not just a gap in eviction courts; it is a full-on chasm. Across nearly every state with data, Black women face eviction more than any other group. This is where the gender pay gap slams into the housing mess: they shoulder the heaviest rent loads compared to income, leaving barely any buffer for tough times.

The Economics of "Junk Fees" and Algorithms

Why is this happening now? The economy is technically growing. Unemployment is relatively low.

The answer lies in how rent is calculated in 2026. It is no longer just about supply and demand; it is about algorithms and fees.

The Algorithm Price Fix Large corporate landlords who file evictions at twice the rate of mom-and-pop owners are using pricing software to push rents to the absolute theoretical limit. These algorithms prioritize revenue over occupancy. They would rather have higher rent and higher turnover (evictions) than stable rent and long-term tenants.

The Death by Junk Fees. Then come the fees. You might sign a lease for $1,600, but your actual bill is $1,850.

- Valet Trash: $30 (Mandatory, even if you do not use it). Smart Home Bundle: $50 (For a keyless entry you did not ask for). Pest Control: $15. Billing Admin Fee: $5 (A fee for the privilege of getting a bill).

For a family living on the edge, these non-negotiable fees are often the difference between staying solvent and getting a “Notice to Vacate” taped to the door.

The Scarlet Letter: The Tenant Screening Industry

The final piece of this crisis is what happens after the eviction.

Even if a tenant wins in court, even if the judge rules in their favor—the mere existence of the eviction filing creates a permanent scar. Tenant screening companies scrape court data daily. That filing lands on a report that future landlords see.

We have created a class of “un-house able” citizens. In 2026, if you have a filing on your record, you are often blocked from corporate-owned housing. You are stuck scraping by in the bottom rung: slumlords, sketchy blocks, or those grim extended-stay motels. It locks families in this mess for years, way past when that first debts cleared.

The Outlook: Speed Over Justice

The hard truth is that in many states, the system is designed for speed, not justice.

In states like Texas, Arizona, and Florida, the laws prioritize clearing the docket. Tenants rarely have legal representation (less than 3% in most jurisdictions), while landlords are always represented.

Compare that to New York City, Philadelphia, or Cleveland, which have implemented “Right to Counsel” laws. In these cities, tenants are guaranteed a lawyer. The result? Eviction judgments drop, settlements rise, and families stay housed

But until federal rules fix that data hole, the GAO flagged and we tackle those algorithm-fueled rent jumps; Sun Belt courts will keep overflowing. Washington’s number-crunchers miss it entirely, but for millions of renters, this mess is their daily grind.

Frequently Asked Questions

Why does the GAO say the U.S. eviction data is incomplete?

Eviction laws are local, not federal. Records are trapped in thousands of disconnected county court systems. Many are still paper-based, and the digital ones do not share data with federal agencies like HUD or the Census Bureau, creating a massive blind spot.

Which U.S. cities have the highest eviction rates right now?

Houston, Las Vegas, and Phoenix are currently seeing some of the highest filing volumes. These “Sun Belt” cities experienced massive rent hikes over the last four years, and wages have not kept pace with the cost of living.

Who gets evicted the most in America?

Statistically, Black women face the highest eviction rates due to the intersection of the wage gap and high rental burdens. Even more alarming, households with children are evicted significantly more often than adult-only households.

Does having a lawyer help in eviction court?

Yes, drastically. In cities with “Right to Counsel” laws (like NYC or Cleveland), tenants with lawyers are much more likely to avoid eviction. However, in most of the country, less than 3% of tenants have legal representation.

How does a "tenant screening" algorithm affect evicted renters?

Tenant screening companies scrape court data. Even if a tenant wins their case, the mere filing of an eviction lawsuit can appear on their background check for years. This “blacklists” them from renting quality apartments in the future.